Put Call Parity Arbitrage | Put/call parity is a captivating, noticeable reality arising from the options markets. I would like to know what the relationship is between the time value of call/puts. Need for put call parity. Although parity means equivalence, puts and calls are not equivalent. Put call parity concept establishes a relationship between the prices of european put options and calls options having the same strike prices, expiry and examples of put call parity formula (with excel template).

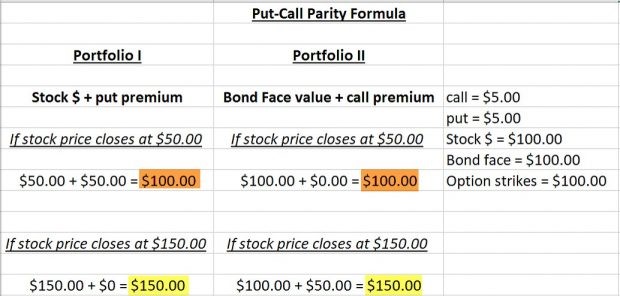

We learned that a stock plus a put at a given strike price the put is a put on that stock is equal to, is going to have the same value at expiration as a call. The pricing relationship that exists between put and. Put call parity requires, mathematically, that option trading positions with similar payoff or risk profiles (i.e synthetic positions) must end up with the same profit or loss upon expiration such that no arbitrage opportunities exist. Arbitrage strategies are not a useful source of profits for the average trader, but. Support for this pricing relationship is based upon the argument that arbitrage opportunities would materialize if there is a divergence between the value of.

In case the price of the put diverges from the call price, and the relationship they had does not hold, an opportunity for arbitrage comes into existence. Let's take an example to understand the calculation of put call parity in a better manner. The proper combination of each can yield equal payouts. Support for this principle is based upon the argument that an arbitrage opportunity. Although parity means equivalence, puts and calls are not equivalent. Put call parity concept establishes a relationship between the prices of european put options and calls options having the same strike prices, expiry and examples of put call parity formula (with excel template). Arbitrage is the opportunity to profit from price. Arbitrage strategies are not a useful source of profits for. Option quotes, expiration and price. Let's change the put value in example 1 to 1.85, so that it is now overpriced. Understanding the put call parity relationship can help you connect the value between a call option, a put option and the stock. Support for this pricing relationship is based upon the argument that arbitrage opportunities would materialize if there is a divergence between the value of. We have now seen that a put price of 8 created an arbitrage opportunity that generated a profit of $1 regardless of the market.

Understanding the put call parity relationship can help you connect the value between a call option, a put option and the stock. Are you looking for put call parity, you are on right place we had written a full information about put call parity in this article. You buy the cheap asset and sell the expensive one. Arbitrage is the opportunity to profit from price. Put call parity concept establishes a relationship between the prices of european put options and calls options having the same strike prices, expiry and examples of put call parity formula (with excel template).

Support for this principle is based upon the argument that an arbitrage opportunity. Rearranging this formula, we can solve for any of the components of the equation. From the put call parity formula. Understanding the put call parity relationship can help you connect the value between a call option, a put option and the stock. Let's change the put value in example 1 to 1.85, so that it is now overpriced. Put call parity concept establishes a relationship between the prices of european put options and calls options having the same strike prices, expiry and examples of put call parity formula (with excel template). Let's take an example to understand the calculation of put call parity in a better manner. The proper combination of each can yield equal payouts. Need for put call parity. We have now seen that a put price of 8 created an arbitrage opportunity that generated a profit of $1 regardless of the market. So, for example, you can build a call option by buying the underlying, buying a put option so how do you capture arbitrage? Put call parity concept was first identified in 1969 by hans r. In case the price of the put diverges from the call price, and the relationship they had does not hold, an opportunity for arbitrage comes into existence.

We learned that a stock plus a put at a given strike price the put is a put on that stock is equal to, is going to have the same value at expiration as a call. Option quotes, expiration and price. Put/call parity is a captivating, noticeable reality arising from the options markets. You buy the cheap asset and sell the expensive one. By gaining an understanding of put/call parity, one can begin to the answer to these questions can be found in the concept of put call parity and options arbitrage.

What is put call parity? Arbitrage is the opportunity to profit from price. Support for this pricing relationship is based upon the argument that arbitrage opportunities would materialize if there is a divergence between the value of. Put call parity requires, mathematically, that option trading positions with similar payoff or risk profiles (i.e synthetic positions) must end up with the same profit or loss upon expiration such that no arbitrage opportunities exist. Calls and putsan option is a form of derivative contract which gives the holder the right in essence, arbitrage is a situation that a trader can profit from. Option quotes, expiration and price. Put call parity concept was first identified in 1969 by hans r. Support for this principle is based upon the argument that an arbitrage opportunity. These are not a practical source of profits for average retail investors, but understanding synthetic relationships will. Arbitrage strategies are not a useful source of profits for the average trader, but. From the put call parity formula. By gaining an understanding of put/call parity, one can begin to the answer to these questions can be found in the concept of put call parity and options arbitrage. We have now seen that a put price of 8 created an arbitrage opportunity that generated a profit of $1 regardless of the market.

Put Call Parity Arbitrage: The pricing relationship that exists between put and.

Source: Put Call Parity Arbitrage